Travel is Unbreakable

The Asia Pacific travel/tech ecosystem is large and diverse. If you’re a player, your prospects depend on what you’re selling, who your customers are, the access you have to technology and capital, and potentially where you are located. We interviewed a dozen C-suite travel/tech executives from Mumbai to Melbourne (and many places in between) to understand what’s new in the post-Covid world. The heterogeneous nature of the region means that some of the observations made by our panel aren’t universally applicable to other markets. With that caveat, here we go…

The Covid-19 consumer-led digital boot camp

During the pandemic, consumers led the travel industry through a digital boot camp, especially in Asia, driving a step change in mobile phone travel bookings. Even the least online part of the travel scene (tours and activities) went through massive change, moving from ~17% to ~30% of sales.

The instantaneous nature of booking via mobile contributed to incredibly dynamic and elastic consumer behavior within the region. Seasoned professionals we spoke to had never experienced ‘on-off’ then ‘off-on’ consumer responses on this scale before.

The consumer, the pandemic and the economy

Covid-19 has baked leisure travel into both our consciousness and our household budgets. Before Covid we could travel at will, but today consumers want to travel now because they don’t know what’s around the corner. Couple that with the digital bootcamp that travel has been through, and the forward landscape looks different.

Holiday travel is now a non-discretionary spend item. Consumers have rediscovered domestic travel, but they still want the thrill of outbound. There’s at least a decade of Australian data showing how holiday travel is locked in at circa 7% of disposable household income. With full employment everywhere, you shouldn’t expect travelling to stop. The type of travel that people do may change - but not the act of travelling itself. For all of these reasons, travel won’t slow down much if there’s an economic slowdown. And if it does – in the words of one experienced strategist – ‘travel is the new lipstick.’

By July 2023, global inbound tourism had reached around 85% of pre-Covid, with Europe and the Americas at 85-90%, Africa at 90%, the Middle East at 120% and APAC, the laggard, at 61%. Within APAC, ANZ had reached around 80% and was heading for 100%. Northeast Asia was running at 45%, Southeast Asia at 70% and South Asia at 93%. Against that backdrop, IATA forecasts that global air passengers will double to 7.8 billion passengers by 2040.

The way people travel is changing. For instance, Chinese tourists have been trading international for domestic travel (in Golden Week Chinese carriers redeployed wide-bodied aircraft to domestic routes). Before Covid, shopping was a priority - but consumers who are now sick of shopping are opting for experiences, often involving nature. Think Pusan and Jeju rather than Seoul. And many consumers are also trading up on quality.

Image: Australian household spending on travel as a percentage of disposable income 2007-22

Planes, trains and automobiles

Airlines may have focused on buying new metal before the pandemic, but these days they’ve delayed fleet replacements to improve yield. Before Covid, low-cost carriers (LCCs) focused mainly on short haul routes but that may change as leisure travel dominates.

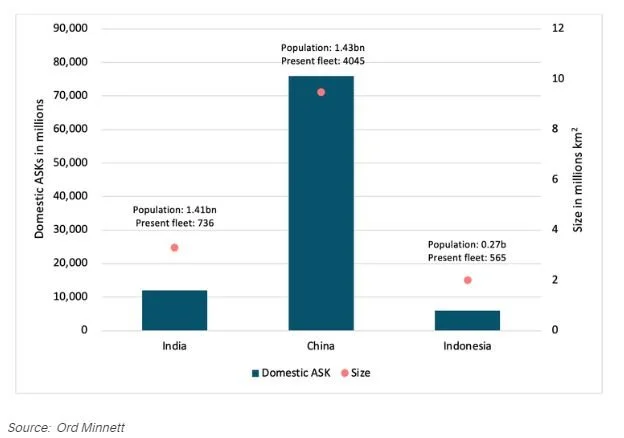

Tourism marketers were focused on attracting Chinese holiday makers before Covid, but that isn’t necessarily the priority anymore. India may just be the new China.

With exceptions, the hotel sector is doing just fine, thank you. CEOs we interviewed spoke of revenues reverting to 2019 levels in 2022 and since reaching new heights. Global hotspots like New York and the major EU capitals are full. Five-star Bali hotels are selling at eye-watering prices. Japan is booming.

What’s not widely understood by travellers is that many hotels still struggle to get staff, and are holding back inventory so they can maintain service levels, jacking up the prices of the rooms they do sell.

Alternative accommodations are still keenly sought by leisure travellers and now by a new category - the bleisure traveller. Airbnb continues its great march forward - albeit with a bloody nose from restrictions placed by New York city. Will other cities follow suit?

Not every part of the value chain has recovered yet. The Australian rental car fleet won’t hit 2019 levels until 2024, with the Kiwis taking 12-18 months longer. Like hotels and flights, bookings are lower than 2019, but TTV is higher as rental car companies have jacked up prices. Similarly, the Australasian campervan fleet is still only at 60-70% of pre-Covid, with commentators blaming high airfares and camper prices (the THL/Apollo merger comes up a lot…) as the root causes of poor demand.

China and India

China is the global recovery’s laggard, stuck at around 50% of pre-Covid outbound numbers. The slow bounce-back stems from a wide range of factors - aircraft and pilot availability, Government policy, visa and passport processing, the economy and cultural quirks.

Before Covid, China was most countries’ key growth market. It remains important but India and the Middle East are now seen as opportunities. The Chinese economy isn’t really a threat to the overall recovery - but it’s slowing the overall rate of growth.

The ~50% of Chinese travellers who are back are visiting Southeast Asia as a substitute for Europe due to flight availability and prices. Younger travellers are opting for nature experiences over the hedonist pleasures of Orchard Road or Central. And in an emerging trend, they’re developing their travel plans through following social media influencers.

Meanwhile, the Indians are coming! India is now by far the largest source of inbound tourists within the region, representing #1 or #2 in most markets. With 40% of India’s population aged under 25, and rising affluence, this generation is on an important trajectory. And with the sale of Air India to Tata Group and Singapore Airlines, expect an epic modernisation program backed by massive orders for new aircraft.

Image: China v. India

Southeast Asia

Most of the travel companies we spoke to cut back heavily during the pandemic but swiftly returned to business afterwards. One hotel wholesaler reported bookings and revenues 30% greater than 2019, with a materially more efficient cost base generating sharply improved margins. Another, marketing 2-3 star Southeast Asian hotels, reported revenues up 300% from trough to peak with GP now 150% of pre-Covid. Different denominator, different result.

Several truths resonate across the region: with limited flight capacity fares are prohibitively high, the ease of securing travel visas is affecting demand, social media is a cornerstone of post-Covid B2C marketing, corporate travel is subdued, and the aggressive online players that were once driven by market share are now becoming more driven by margin.

Singapore was the first Southeast Asian country to re-open and is experiencing a strong recovery, driven by the perception that it is both safe and welcoming (not to mention by Hong Kong’s prolonged border closure). Malaysia is reportedly about 85% recovered largely due to a strong domestic market.

Indonesian domestic travellers are still the main source of business. Bali is the only destination with credible international demand, although the Government is trying to promote other destinations. Depending on who you speak to, Bali’s 5-star hotel scene is sizzling hot with room rates of US$500-$1,000 per night, or more. Operators report that outside of the Bali market, Indonesia is recovering, but not as well as Singapore or Malaysia.

Having expected a strong Summer that didn’t materialise, Thailand is looking stronger going into the Northern Hemisphere winter. The business has been supported by Russians and Middle Eastern inbound travellers while Chinese demand has been down. The new Thai government recently implemented a visa-free policy for Chinese travellers to stimulate demand.

There are numerous anecdotes about who is travelling now, and who is not - e.g. several CEOs reported an influx of Russian and Ukrainian long-term tourists buying long term stays a few months back (cash up front, offline). Equally, they told us that “the young European traveller” is travelling less to Asia.

North Asia

If India is the new China, Japan is the new France. It’s where everyone is going. The combination of culture, dining, cleanliness (no bed bugs?) and a low yen make it very attractive. Couple strong inbound with a domestic population that doesn’t want to leave the country (for fear of bringing back disease) or can’t afford to (because of the low Yen and high fares), and you have a recipe for boom times. For at least one player we interviewed, Japan has reached 300% of its pre-Covid level.

The South Korean travel landscape also changed significantly during the pandemic. Yanolja has been the big mover, building its domestic travel market share and giving traditional rivals like Hana Tours a run for their money. Not to mention its international M&A program. With key digital channels growing in popularity, the shift to online is happening at great speed.

ANZ

Our sources tell us that with domestic capacity down, prices up and a changed mix, domestic travel bookings are sitting at just over 80% of 2019 levels, but TTV is up. With less business travel being done in the golden triangle (underpinning profitability), flight cancellations are running high.

One CEO quoted outbound bookings at 80-90% of 2019 levels, with average booking values ~25% higher. Notably, demand is off the charts for Southeast Asia and Japan, and has been high for EU destinations. One notable exception is the UK, where no one seems to want to go right now.

Early bird fares are being offered for the first time in years. Is this a signal that carriers have less confidence they will be able to sell unsold inventory at high prices at the last minute, so they want to bank revenues up front?

Greta Thunberg, where are you?

We all understand that sustainability has become a catch cry for large corporates and governments, who find themselves under pressure to visibly integrate sustainability into their decision-making processes. However, is that replicated among consumers?

The concept of ‘flygsam’, or flight-shaming, arose in Sweden in the years before the pandemic. It has since gained popularity in Germany, France, and the UK, with travellers “train bragging” or posting pictures of their train journeys on social media.

But what is the real consumer demand for lower carbon travel? A study by Expedia found that 90% of consumers look for sustainable options when travelling, but that around 70% feel overwhelmed by the process. Increasingly, travelling consumers view it as the obligation of their service providers - not themselves - to adopt sustainable practices.

The study also found that consumers are willing to pay more for travel products if they’re more sustainable. However, when we checked with two organisations offering carbon offsets against travel purchases - the attachment rate for offsets has actually fallen since the pandemic. Go figure.

Corporate travel

Covid-19 reserved perhaps its most profound impact for corporate travel. With working from home now an established norm, many external meetings being done by video and CFOs getting used to lower travel budgets, there’s no hurry to get people back into the field. So the future for corporate travel is less certain.

APAC business travel is reportedly at 80-90% of pre-Covid, the same in EU, but more sluggish in the USA at 60-80%.

Bleisure is an emerging trend. People travelling for bleisure often now seek out alternative accommodations, which travel management companies (TMCs) now need to offer.

As a result of this shift we are seeing occupancy skewed towards weekends. In Las Vegas for example the return to office means fewer visitors during the week - but lots of visitors and higher prices at weekends.

The corporate travel C-Suite executives we interviewed made a few points about the future of TMCs. They see corporate travel as crowded and inefficient, with opaque incentive structures - and ripe for disintermediation. At the same time, a plethora of smaller tech companies is trying to disrupt the space, from Serko to Tripactions (now Navan) to Spotnana (a turnkey TMC-as-a-service).

Technology

Travel features literally thousands of legacy technology platforms, some up to half a century old. Changing the status quo was not an option prior to Cov-19 as it would have required disruption to revenue models, processes, job losses and major transformation. Covid-19 changed all of that. With no customers, the smarter travel companies used the downtime to fundamentally reinvent their tech stacks.

We asked all twelve of our C-suite travel executives about the impact of technology. Generative AI was (of course) at the top of the list. This technology has grabbed everyone’s attention super quickly - even faster than iPhone adoption did - but the jury is out on how quickly it will disrupt online travel. Travel research company Skift has had a lot to say about this recently, reporting on new initiatives from Meta, Microsoft and AWS.

Smart operators are experiencing material wins in the back end of their businesses, and emerging wins in the mid-end - content, pricing, supply optimisation, marketing collateral and so on. However the front end - searching for travel products and giving advice - is where the consensus ends.

Several people interviewed had listened to Rafat Ali’s interview of Jason Calacanis and Brad Gerstner at the recent 2023 Skift Global Forum, where Gerstner’s war cry was:

“12 months from now, I guarantee you you’ll be able to say, book me three Michelin star restaurants when I’m in Hong Kong and book me a flight business class. I want a sleeper seat with the best wi-fi and I want to go for a week…I don’t care what days I leave…that entire agenda will be done for you off three sites, Open Table, Google Flights and whatever.”

[Gerstner went on to ask whether the giant OTA incumbents like Expedia and Booking would be advantaged by generative AI, or whether their incumbency will inhibit their ability to reinvent themselves, leading to their own disruption].

Our panel agreed with the vision but definitely not with the speed. We may be at the cusp of a new way of doing online travel but at the front end it’s not twelve months away. Some technology platforms are even advising their clients to not use generative AI in customer-facing use cases just yet.

Is generative AI going to disrupt the value chain now Covid has unfrozen it? The best guess from the more tech-savvy executives we interviewed was it’s going to take at least 3-5 years for this to occur at scale. Two of the more colourful responses to this line of questioning were “think annual gains of 10%, not 10x”, and “it’s like teenage sex - everyone talks about it but no-one’s doing it.”

In the here and now, other innovations are already making an impact. There’s a very long list - payments are evolving, “hyper localisation”, the TikTok revolution and live commerce in travel (reference the Chair of Trip.com dressed up as a woman promoting a Banyan Tree property on social media in China!), NDC and the existential threat it poses to agents and GDSs, the rise and rise of cloud costs (“airlines don’t understand how costly their NDC programs are going to be!”), tools to manage hotel distribution and pricing, pre-arrival technologies, the in-room hotel experience, and massive improvements in rental car customer experience (e-signing contracts, document verification, automated pick-up and drop-off via mobile apps).

The last word: “forget AR and VR – they’re just a marketing tool, but no substitute for being there in person.”

[Disclosure: NRP founder Roger Sharp is the Non-Executive Chair of digital travel company Webjet].