Software Companies Have Given Up Years Of Multiple Expansion, And Profitability Is Back In Vogue

A decade’s worth of digital transformation, supercharged by two years of COVID-fuelled acceleration, delivered a boon for software businesses.

On top of that, access to cheap money, the expansion of the Chinese economy and relatively benign economic and political circumstances around the world created an unusually favourable environment for software entrepreneurs.

The sun was always shining — until it wasn’t.

The ‘grow at all costs’ era also appears to be waning, with software valuations now more evenly rewarding growth, scale and profits – or a clear path to these outcomes. Indeed the key to value direction now appears to be operating performance and capital efficiency.

That message is clearly getting through.

According to industry publication The Information, company leaders are “…freezing hiring or cutting jobs and curbing spending in areas including travel, marketing and software in the face of falling stock prices and an economic slowdown that threatens to turn into a recession.”

Software valuations have retreated, along with the wider technology sector. With the recent pain seen in public equity markets, the temptation is to focus on the short term. However, drawing back and taking a longer-term perspective on software valuations provides useful insights.

At North Ridge Partners, we have tracked the data back to understand better where we have come from pre-COVID, what the top of the bull market looked like, and how it has subsequently all shaken out. Ultimately, that helps us to understand what that might mean in the near term for software valuations.

First, though, with software being such a broad category it's important to create some guard rails around the discussion. For this month’s column, we are focusing our analysis on two categories: software as a service (SaaS) and Enterprise software.

In this article, we look at the valuation metrics across the US as the deepest tech market, while in article two we look at Asia and ANZ.

Also, for this analysis, we have focused on revenue multiples only. Obviously we’re no longer living in 2021, and profit multiples are finally back in the lexicon — but to have sufficiently large data sets to draw some longitudinal conclusions, we’re stuck with revenue. SaaS in particular is still dominated by unprofitable companies.

US technology stocks at their 2021 peak were up 220% over 2015 levels, twice the increase of the broader equity market. The recent correction has given up just over 30% from that peak. In trying to understand where this leaves valuation drivers, we’ve focused on revenue growth over the same period and what this has meant for valuation multiples.

In the US, SaaS revenue multiples expanded significantly across 2017–2021, broadly doubling over that period across all sizes of companies. Larger business multiples expanded from around 10x to 20x, in the mid-tier from around 7x to 15x, and for smaller SaaS providers from about 4x to 8x.

After this prolonged period of growth, the upwards re-rating has subsequently been given up in the recent market correction, and with the growth in revenues the resulting multiples have consistently retreated back to 2016–2017 levels.

The absolute multiple premium for larger SaaS companies, which expanded over the recent bull run, has also compressed significantly. Mid to large SaaS organisations are now consistently priced at approximately 8x trailing revenues. The smaller end of the SaaS market has generally traded at about a 50 per cent discount to its larger brethren, and that relationship seems to have held — the small end of the US SaaS market is currently valued back at 4x revenue.

The US Enterprise software space, while not seeing the same absolute highs, has seen a multiple profile that is broadly consistent with that seen in the SaaS subsector.

After peaks in late 2021, the larger Enterprise segment however has not seen a full retreat in the same way that SaaS has, with average multiples of 8x remaining. This suggests that these businesses have held onto about 30–50 per cent of their gains since 2015 levels.

Growth and … oh, that’s right, profitability

The expansion of multiples, particularly over 2019–2021, was most notable in the mid (20–35 percent) and high (35 percent+) growth US SaaS companies, growing by 150–200 percent over the preceding period.

The reductions in multiples over the past 6–12 months have been just as profound, retreating to longer-run levels across the board.

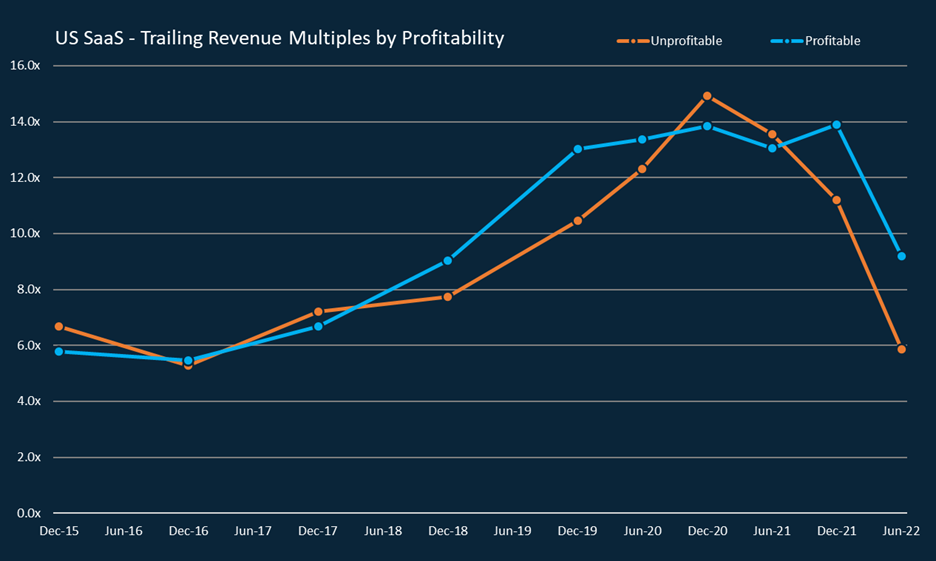

And it also appears that profitability is in vogue. Previously, it has not driven a notable difference in multiples across the US SaaS universe — with generally less than a 20 percent variance across profitable vs unprofitable cohorts.

But we are now seeing a much more significant deviation in multiples. Profitable US SaaS businesses are being rewarded by investors with a roughly 60 percent profitability premium in revenue multiples.

Private markets

Finally, to private markets, where the story, as ever, is more opaque. And — at least based on the available data — it’s a little different as well.

Globally, private markets experienced strong growth in deal activity and investment prior to 2022. For instance, $50 billion was invested in minority/growth deals alone in 2021, which was more than twice the previous high mark. In fact, deal values are up 600+ per cent on 2015 levels.

For now, it appears that the impact of the recent public market valuation reset is only partially flowing through into the private markets.

Median valuations tracked by PitchBook for late-stage SaaS VC have retreated by about 23 percent from the highs of 2021. However, it’s important to note that these median valuations remain well above longer-run averages and have not shown the same regression as public markets to date.

Furthermore, earlier stage median valuations appear — for now — to be largely immune to the recent downturn. That picture may change in coming quarters, as the structured elements of deals (for example liquidation preferences, etc.) are likely moving ahead of headline valuations to deal with this ‘risk-off’ environment.

The Takeout

All boats rise with the tide, but they also fall the same way and the tide has been ebbing now for six months. Individual stock values are now more likely to be driven by how SaaS and Enterprise companies’ revenue growth profile is affected by the new normal – high interest rates, supply chain constraints, changes in work-from-home, and the industry focus and relative impact of these factors on individual software company clients.

That’s not to say there won’t be any further downside risk in multiples, but we suspect that will be a short-term factor and conclude that the impact on valuations from the multiple de-ratings has largely played out.