2022 by the Charts

As the bells start to jingle and the Auld Lang starts to Syne it’s time to look back at the year, through the blunt and irrefutable lens of hard data.

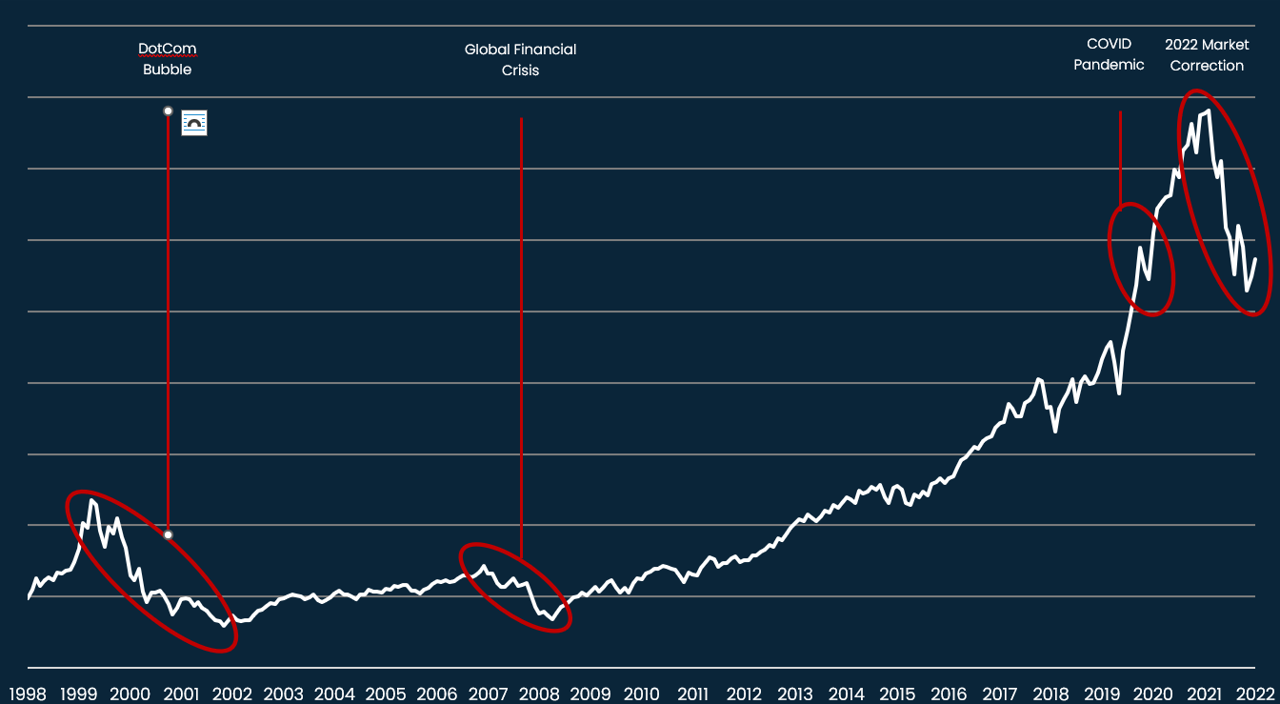

2022 market correction in context (NASDAQ)

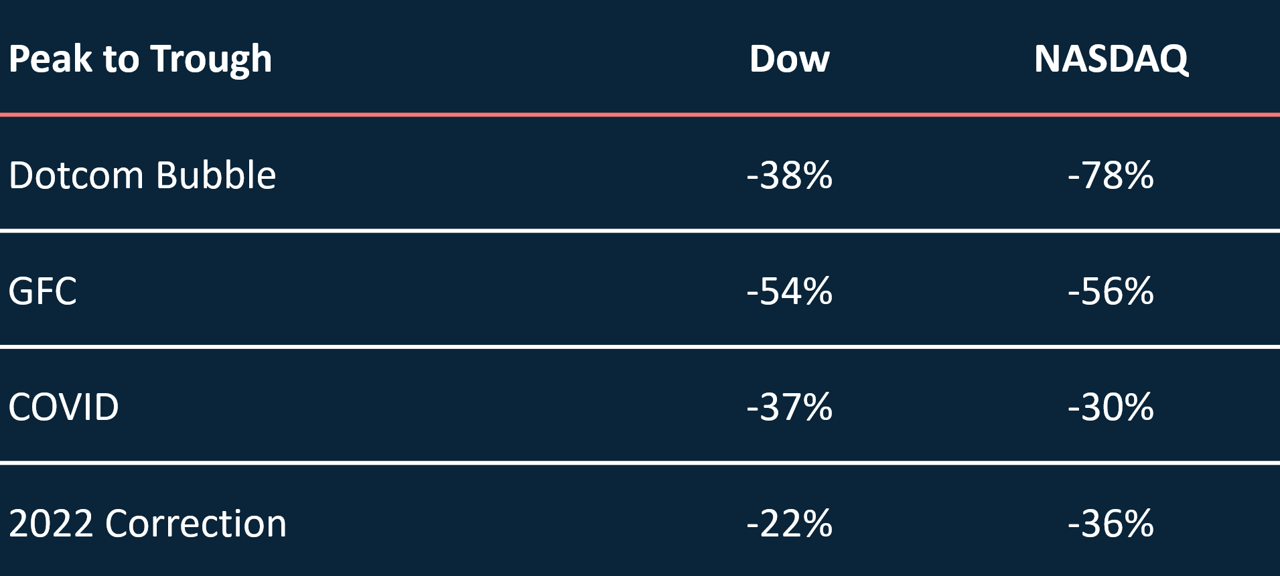

The value of NASDAQ technology stocks fell 36% from their peak during the correction of 2022. That’s a similar reversal to that experienced at the start of the pandemic - but short of the declines experienced in the 2008 global financial crisis (GFC) or the spectacular bursting of the dot-com bubble in 2000 (50-80%, respectively).

The NASDAQ correction doesn’t tell the whole story, however – with large numbers of Tech small caps falling 50-90% from peak to trough in 2022. Share prices for many well-known names like Robinhood, Block, Zoom, Shopify and Peloton have been truly smashed this year – far worse than a 36% NASDAQ correction might imply.

Re-convergence of valuation multiples across 2022

After the GFC, broader industrial multiples settled at ~7x EBITDA, with Tech generally trading at a ~10% premium. EBITDA multiple expansion started again from 2013, with broader market multiples progressively moving up to ~11x EBITDA by 2018. Throughout that time the Tech sector maintained its premium.

From 2018 to 2021 the Dow Jones average EBITDA multiple rose from 11x to 15x. During this time the Tech premium also expanded to 30-40%, driving Tech multiples to levels not seen since before the 2000 Tech bubble.

As with most other sectors, economic factors are now weighing on Tech, with a rapid reset of the Tech valuation premium back to its long-term average of ~10%.

ANZ’s less mature Tech markets typically attract a higher valuation premium than their US counterparts. Having said that, the ANZ Tech premium also reverted towards its long run average during 2022, with the NZX IT index at 18x EBITDA (vs 12x for the broader market) and the ASX All Tech index at ~20x (around twice the All Ordinaries).

Tech continues to deliver long run capital outperformance

Tech is still delivering higher long-term capital returns, despite these higher highs and bigger corrections. In fact, whether you take a five, ten or 20-year view, tech consistently outperforms the broader market capital returns by ~40–50%.

Cash is king but only if you keep it - Profit Rules Again

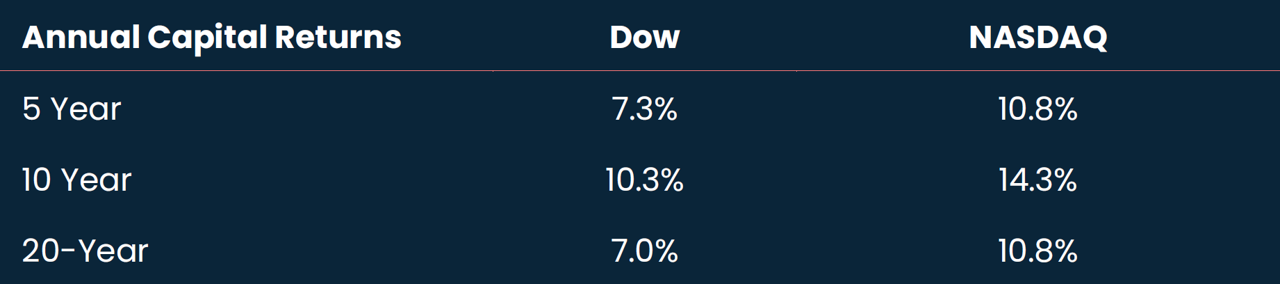

*Profitability was based on the last twelve months net profits of companies listed NASDAQ

It’s amazing how easy is it to make money when money is free. Alas, the higher cost of capital has put a huge focus on unprofitable Tech companies. During the first dotcom boom, Tech entrepreneurs used to brag about site visitors and eyeballs. More recently, that was substituted for cash burn (as some sort of proxy for fast market share growth).

Life has moved on, with the dotcom kids now having kids of their own, and business models maturing. There will be many more survivors from this downturn than from the dotcom bust. Founders everywhere are trimming, extending their cash runway and plotting how they can move into profit.

In 2022 this focus on profitability has been reflected in the numbers, with the median valuation for unprofitable companies down ~55% versus ~13% for profitable peers.

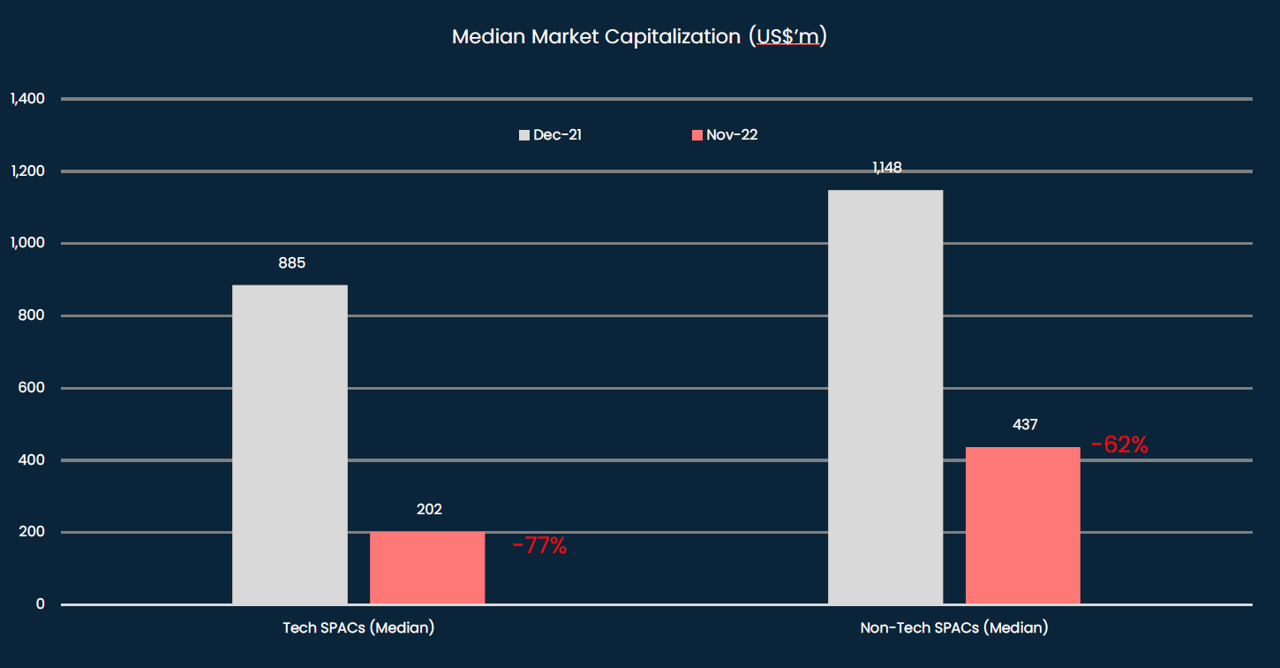

SPAC moment in the sun has passed

Like Tulips and NFTs, SPACs had their brief moment in the sun before returning to the cool shade. Those often eye-watering valuations imploded in the 2022 market correction, vastly exceeding the broader market downturn. SPAC valuations dropped by ~80% in 2022. With future planned mergers getting pulled on an almost daily basis, we don’t expect to see much SPAC activity until the next boom.

Despite ESG pressures, energy was the clear winner in 2022

The great irony of the year is that, at the very moment the global transition to cleaner energy felt like it was finally reaching a full head of steam, hydrocarbon-based stocks went on an absolute tear. The cocktail party invites may have dried up for those unfashionable hydrocarbon-based stocks, but they were the clear winners in 2022 - even if it was for the worst of reasons!

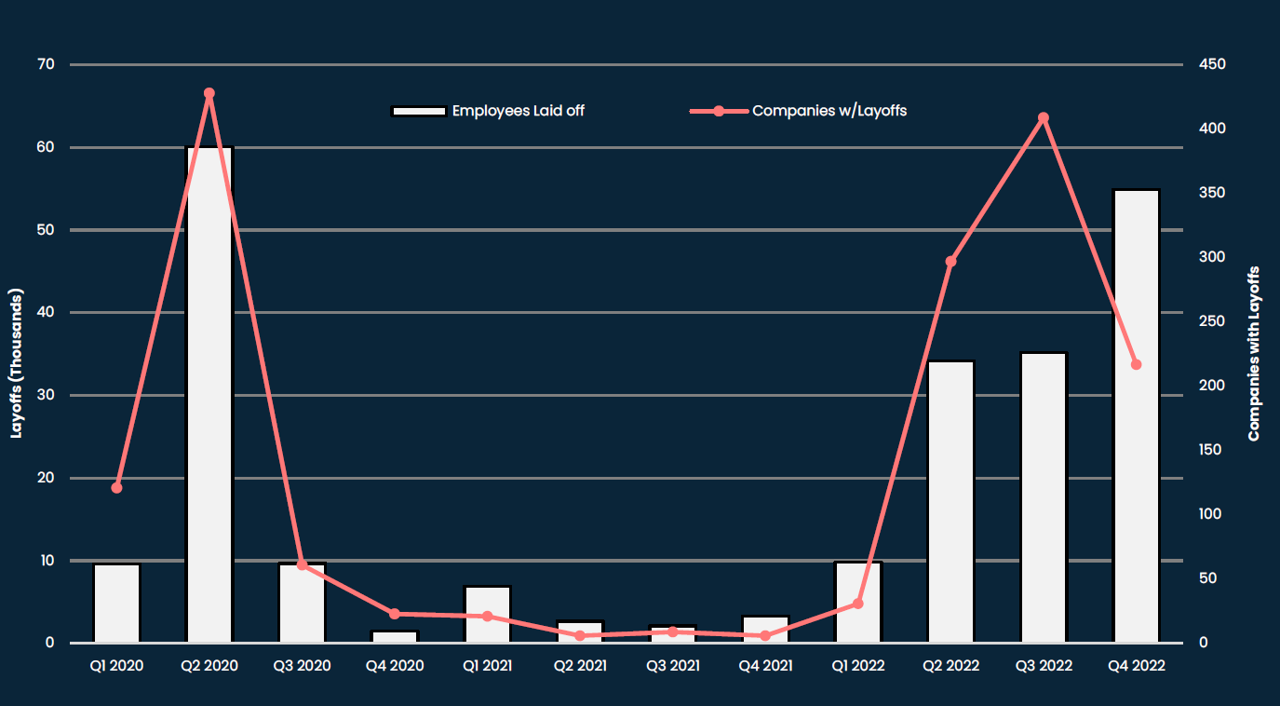

Reductions in Force (RIFs) trending rapidly upwards over 2022

Finally, we’ve all seen the press covering the latest staffing cuts, as big and small Tech adjust to the new normal – making money! The unwinding of a long period of ultra-cheap capital has forced Tech companies to live by the rules that almost all other businesses live with - sustainable growth and profitability are required for short-term survival and long-term growth. Data shows layoffs increasing rapidly from Q2 - we don’t expect this trend to change in the first half of 2023.

A Final Word

History isn’t the same, but it sure rhymes. A lot of money is going to be made by brave investors in this Tech down cycle. Potentially good businesses are going to be forced to take their medicine, and become profitable. For those that pass the test, growth rates, multiple expansion and the Tech premium will do the rest.